Not known Facts About Frost Pllc

Not known Facts About Frost Pllc

Blog Article

A Biased View of Frost Pllc

Table of ContentsGetting The Frost Pllc To WorkThe 6-Minute Rule for Frost Pllc10 Easy Facts About Frost Pllc ExplainedNot known Facts About Frost PllcHow Frost Pllc can Save You Time, Stress, and Money.

CPAs are among the most trusted occupations, and for excellent factor. Not just do CPAs bring an unequaled degree of expertise, experience and education and learning to the process of tax planning and managing your cash, they are particularly educated to be independent and unbiased in their work. A CPA will certainly help you shield your passions, listen to and address your worries and, equally essential, provide you peace of mind.In these defining moments, a certified public accountant can offer more than a general accountant. They're your trusted consultant, ensuring your service remains financially healthy and legally safeguarded. Working with a local certified public accountant firm can positively impact your company's economic wellness and success. Below are five vital advantages. A regional CPA company can assist minimize your business's tax obligation problem while making sure compliance with all applicable tax laws.

This growth shows our devotion to making a positive impact in the lives of our customers. Our commitment to excellence has actually been acknowledged with multiple distinctions, consisting of being called among the 3 Best Bookkeeping Firms in Salt Lake City, UT, and Best in Northern Utah 2024. When you collaborate with CMP, you enter into our family members.

The Of Frost Pllc

Jenifer Ogzewalla I've worked with CMP for a number of years currently, and I've truly appreciated their experience and efficiency. When bookkeeping, they function around my routine, and do all they can to preserve connection of employees on our audit.

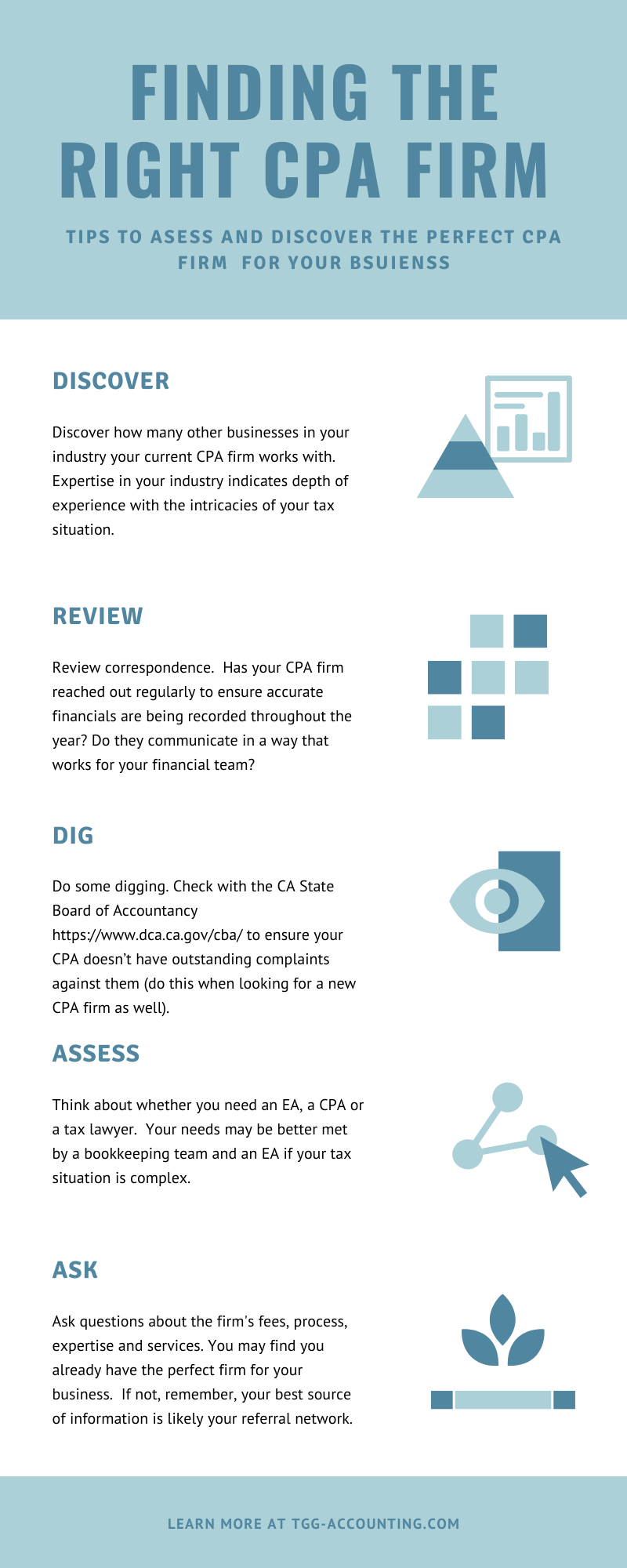

Here are some vital inquiries to guide your choice: Check if the CPA holds an energetic permit. This guarantees that they have passed the needed examinations and meet high moral and professional requirements, and it shows that they have the certifications to handle your monetary matters sensibly. Verify if the CPA provides solutions that align with your company requirements.

Small companies have unique financial demands, and a certified public accountant with appropriate experience can offer even more customized recommendations. Inquire about their experience in your sector or with businesses of your size to ensure they recognize your certain challenges. Understand just how they bill for their services. Whether it's per hour, flat-rate, or project-based, understanding this upfront will prevent shocks and validate that their services fit within your budget plan.

Hiring a local CPA company is more than just contracting out monetary tasksit's a clever investment in your company's future. Certified public accountants are accredited, accounting specialists. Certified public accountants may function for themselves or as component of a firm, depending on the setup.

documents to a company that concentrates on this area, you not just cost-free on your own from this time-consuming job, however you also complimentary on your own from the danger of making blunders that can cost you monetarily. You might not be making use of all the tax obligation savings and tax obligation reductions offered to you. The most crucial concern to ask is:'When you save, are you helpful resources putting it where it can grow? '. Lots of companies have executed cost-cutting procedures to lower their total expenditure, however they have not place the cash where it can assist the business expand. With the help of a certified public accountant company, you can make one of the most educated choices and profit-making approaches, taking into consideration the most present, current tax policies. Government firms whatsoever levels require documentation and compliance.

Unknown Facts About Frost Pllc

Tackling this obligation can be an overwhelming job, and doing glitch can cost you both monetarily and reputationally (Frost PLLC). Full-service CPA companies know with declaring demands to ensure your business complies with government and state laws, as well as those of financial institutions, capitalists, and others. You may need to report added income, which might need you to file an income tax return for the very first time

Certified public accountants are the" huge guns "of the accounting sector and typically do not take care of daily accounting tasks. Usually, these other types of accounting professionals have specializeds throughout locations where having a CPA license isn't called for, such as monitoring accounting, not-for-profit audit, expense bookkeeping, government bookkeeping, or audit. As an outcome, utilizing an audit solutions firm is typically a much better worth than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to support your ongoing financial recurring economic.

Brickley Wealth Monitoring is a Registered Investment Adviser *. Advisory see this site services are only used to clients or potential customers where Brickley Wealth Administration and its agents are correctly licensed or excluded from licensure. The details throughout this internet site is solely for educational functions. The content is developed from sources believed to give exact information, and we conduct reasonable due persistance evaluation

nonetheless, the info contained throughout this web site goes through alter without notification and is not devoid of error. Please consult your financial investment, tax, or lawful advisor for help regarding your specific circumstance. Brickley Wealth Administration does not offer lawful advice, and nothing in this web site will be understood as lawful advice. To learn more on our company and our advisors, please see the latest Form ADV and Component 2 Pamphlets and our Customer Partnership Recap. The not-for-profit board, or board of directors, is the legal regulating body of a not-for-profit organization. The participants of a not-for-profit board are accountable for comprehending and imposing the legal requirements of an organization. They additionally focus on the high-level method, oversight, and accountability of the organization. While there are numerous candidates worthy of joining a board, a CPA-certified accountant brings an one-of-a-kind skillset with them and can act as a valuable resource for your not-for-profit. This firsthand experience gives them understanding right into the practices and techniques of a solid managerial group that they can then show to the board. Certified public find here accountants also have experience in establishing and improving business policies and treatments and analysis of the practical requirements of staffing models. This gives them the special skillset to examine management teams and provide recommendations. Secret to this is the capacity to recognize and interpret the nonprofits'annual financial statements, which provide insights right into exactly how a company produces earnings, how much it costs the company to operate, and just how effectively it handles its donations. Often the monetary lead or treasurer is charged with managing the budgeting, projecting, and review and oversight of the economic info and economic systems. One of the advantages of being an accounting professional is working very closely with members of various companies, consisting of C-suite executives and other choice makers. A well-connected CPA can take advantage of their network to aid the organization in various calculated and seeking advice from duties, properly linking the company to the optimal prospect to meet their requirements. Following time you're wanting to fill a board seat, take into consideration reaching out to a CPA that can bring value to your organization in all the methods noted above. Intend to find out more? Send me a message. Clark Nuber PS, 2022.

Report this page